Key financial metrics for tech growth

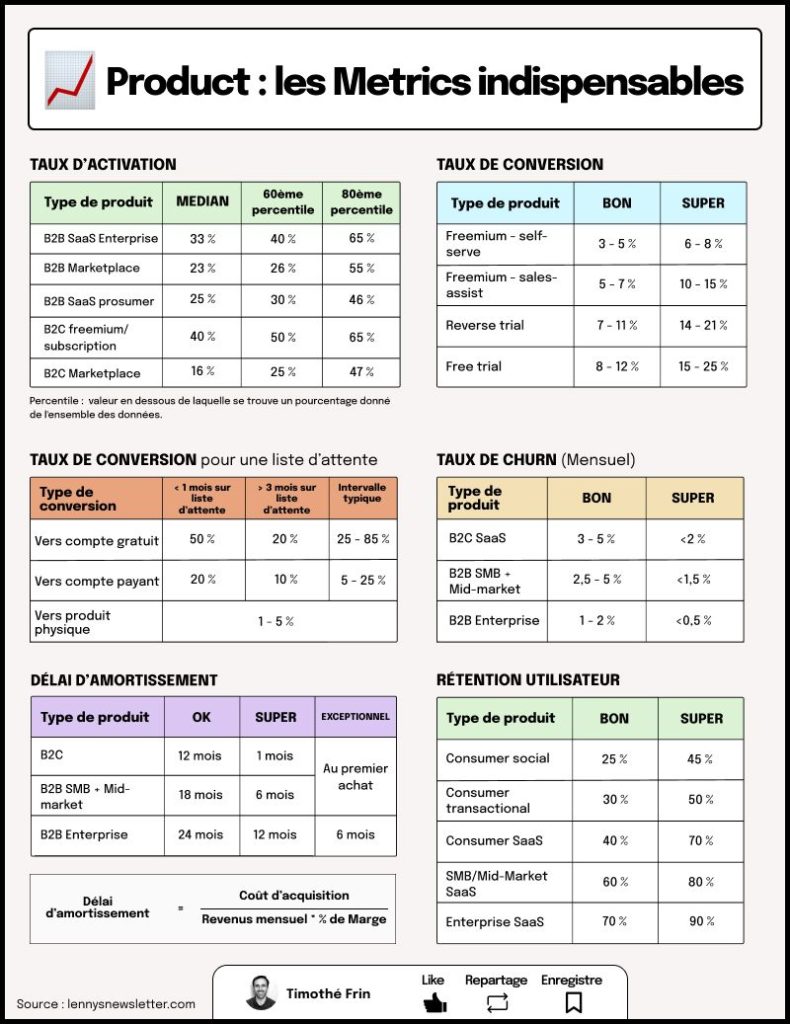

Voici quelques formules à connaître , en anglais pour coller au tableau ci-apres :

Spécial bourse

EPS = Earnings per Share (EPS)

Net Profit / Total Shares Outstanding

PE = Price-to-Earnings ( PER en France) :

Price per Share / EPS

ROI = Return on Investment : Net Profit / Total Investment

ROE = Return on Equity :

Net Profit / Shareholders Equity

ROA = Return on Assets :

Net Profit / Total Assets

Spécial startups

MRR = Monthly Reccuring Revenues :

Operating MRR + new MRR – Churn MRR + Expansion MRR – Contraction MRR

ARR = Annually Recurring Revenues

CH = Churn : lost MRR / Opening MRR

ARPU = Total revenues / number of clients

CLV = Customer lifetime value : average monthly revenue* average month’s active

CB = Cash Burn : Cash from Operating Activities + Cash from Investing Activities

NPS = Net Promoter Score :

% Promoters – % Detractors

Les incontournables

OCF = Operating Cash Flow = Net Income + Other Non-Cash Items – Changes in Working Capital

FCF = Free Cash Flow : Operating Cash Flow – Capital Expenditures

CCC : Cash Conversion Cycle : Days of Inventory Outstanding + Days of Sales

Outstanding – Days of Payables Outstanding

NCF = Net Cash Flow : Operating Cash Flow + Investing Cash Flow + Financing Cash Fl.

DCF= Discounted Cash Flow :CF17 (1+5)1 + CF2 (1+52 + ….. + CEn / (1+r)n, where CF

is cash flow, r is the discount rate, and n is the number of periods.

FV = Future Value : CF x (1+r)^t, where CF is cash flow, r is the interest rate, and t is the number of periods.

PP = Payback Period :

Initial Investment / Annual Cash Flow

CR = Cash Ratio 🙁 Cash + Marketable Securities) / Current Liabilities

GP = Gross Profit : Total Revenue – Cost of Goods Sold (COGS)

EBITDA = Earnings Before Interest Taxes Depreci. & Amort: Net Income + Int Expense – Int Income + Taxes + Depr + Amort

GPM = Gross Profit Margin : Gross Profit / Revenue

NOI= Net Other Income:

Other Income – Other Expense

OM = Operating Margin :

Operating Income / Revenue

ROCE = Return on Capital Employed

Operating Profit / Capital Employed

Beaucoup d’autres ratios & définitions dans le tableau de synthèse ci-dessous, que j’ai emprunté à Josh Aharonoff, CPA (US)